Yearly Earnings Limit Social Security 2024

Yearly Earnings Limit Social Security 2024. Read more about the cola, tax, benefit and earning amounts for 2024. If you will reach fra in 2024, the earnings limit goes up to $59,520 and $1 is deducted from your benefits for every $3 you earn over that.

Social security limit for 2022 social security genius, the estimated average social security benefit for retired workers in 2024 is $1,907 per month. In 2024, you can earn up to $22,320 without having your social security benefits withheld.

The Limit Is $22,320 In 2024.

Workers earning less than this limit pay a 6.2% tax on their earnings.

If You Will Reach Full Retirement Age In 2024, The Limit On Your Earnings For The Months Before Full Retirement Age Is $59,520.

For people attaining nra in 2024, the annual exempt amount is $59,520.

If You Are Working, There Is A Limit On The Amount Of Your Earnings That Is Taxed By Social Security.

Images References :

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Source: ellyqrochella.pages.dev

Source: ellyqrochella.pages.dev

What Is The Social Security Earnings Limit For 2024 Amii Lynsey, There is no limit on earnings for workers who are full retirement age or older for the entire year. Once you actually attain full.

Source: ellyqrochella.pages.dev

Source: ellyqrochella.pages.dev

What Is The Social Security Earnings Limit For 2024 Amii Lynsey, The estimated average social security benefit for retired workers in 2024 is $1,907 per month. Once you actually attain full.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. Be under full retirement age.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit. In 2024, you can earn up to $22,320 without having your social security benefits withheld.

Source: dulcineawsabra.pages.dev

Source: dulcineawsabra.pages.dev

What Counts Towards Social Security Earnings Limit 2024 Geneva, This amount is known as the “maximum taxable earnings” and changes each. How work affects your social security.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

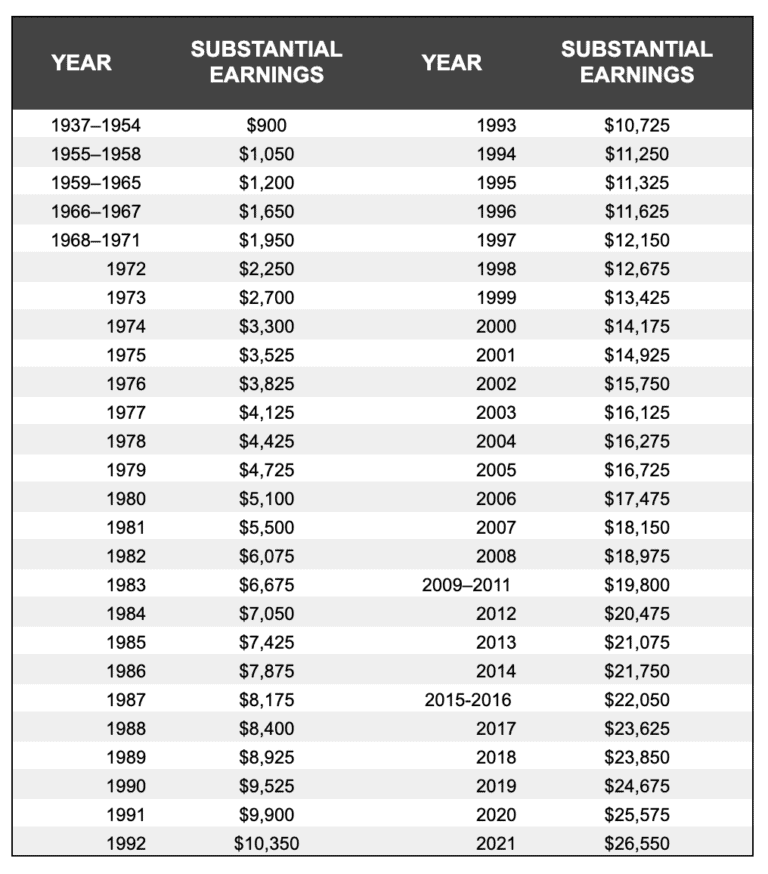

Substantial Earnings for Social Security’s Windfall Elimination, The special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings. (the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits.

The History of the Social Security Earnings Limit Social Security, Social security limit for 2022 social security genius, the estimated average social security benefit for retired workers in 2024 is $1,907 per month. The estimated average social security benefit for retired workers in 2024 is $1,907 per month.

Source: www.forbes.com

Source: www.forbes.com

Social Security Checks To Get Big Increase In 2019, This higher exempt amount applies only to earnings made in months prior to the month of nra. (the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

Social Security Limit 2023 Social Security Intelligence, For people attaining nra in 2024, the annual exempt amount is $59,520. If you will reach full retirement age in 2024, the limit on your earnings for the months before full retirement age is $59,520.

Source: cahraqanastasie.pages.dev

Source: cahraqanastasie.pages.dev

2024 Ssdi Earnings Limit Sharl Natalina, Here's a look at the most you can. There is no limit on earnings for workers who are full retirement age or older for the entire year.

Be Under Full Retirement Age.

But that limit is rising in 2024, which means seniors who are working and collecting social.

If You Will Reach Fra In 2024, The Earnings Limit Goes Up To $59,520 And $1 Is Deducted From Your Benefits For Every $3 You Earn Over That.

In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit.